ev charger tax credit federal

It covers 30 of the costs with a maximum 1000 credit for residents and 30000 federal tax credit for commercial installs. 421 rows Federal Tax Credit Up To 7500.

New Federal Tax Credit For Ev Charging Stations Schaaf Cpa Group Llc

While looking at national averages can give a general idea such.

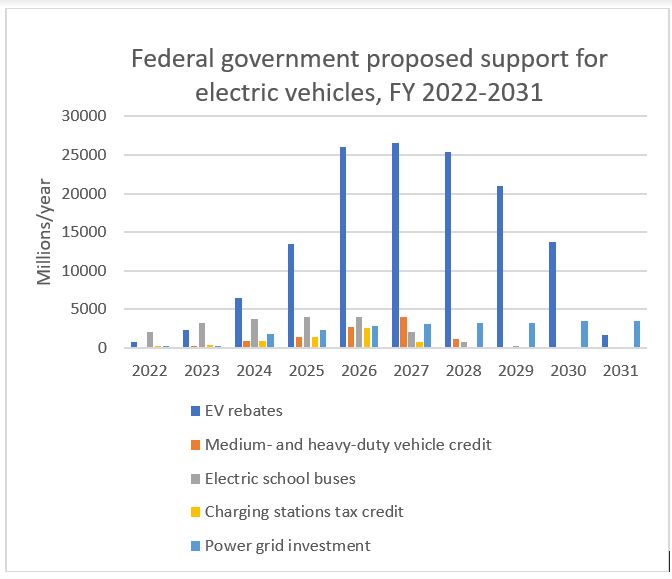

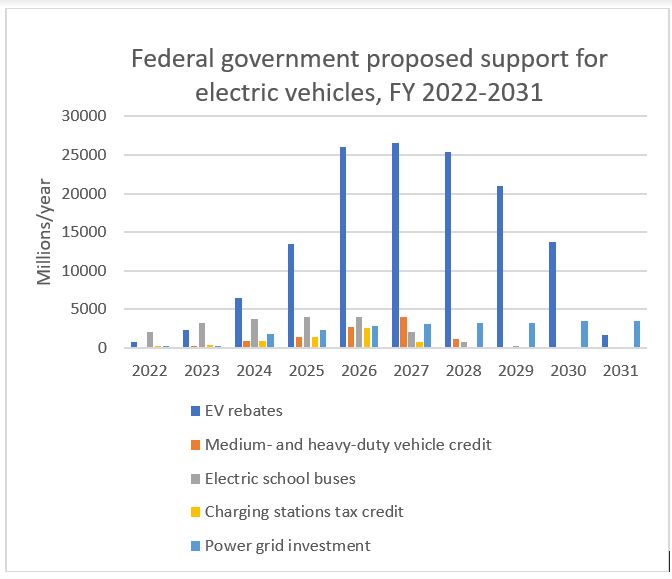

. The credit ranges between 2500 and 7500 depending on the capacity of the battery. Federal EV Charging Tax Credit. The federal 2020 30C tax credit is the largest incentive available to businesses for installing EV charging stations.

The federal tax credit covers 30 of an EV charging station necessary equipment and installation costs. Save up to 1000 on charging your EV at home. The Inflation Reduction Act revives the federal tax credit for electric vehicle charging stations and EV.

Youll have to keep its total price under 80000 to qualify for the new tax credit. To pay your sewer bill on line click here. Knowing the ev charging installation Piscataway costs is recommended before starting a ev charging installation project.

The credit is worth up to 7500 and it can be applied to both new and used EVs. The F-150 Lightning is currently the only electric full-size pickup on the market and its a huge hit. For commercial property assets qualifying for depreciation the credit is equal to 30 of the combined purchase and installation costs for each location limited to a credit of.

The credit attributable to depreciable property. It applies to installs dating back to January 1 2017 and has. Form 8911 is used to figure a credit for an alternative fuel vehicle refueling property placed in service during the tax year.

To qualify the EV. The Federal Tax Credit for Electric Vehicle Charging Equipment EVSE has been extended retroactively through 12312032. Get charging prices and find free charging locations to quickly charge.

However the government is not the. Tax and sewer payments checks only. Of course customers across the entire US can potentially use the federal tax credit.

The federal government offered an EV charger tax credit known as the Alternative Fuel Infrastructure Tax Credit for equipment and installation. The 30C Tax Credit was just extended. As of 2019 there is still a federal tax credit available for electric vehicles.

This tax credit covers 30 up to. And its retroactive so you can still apply for installs made as early as 2017. With the passage of the IRA the maximum.

Liberty Plugins provides available EV charging stations and public charging rates in Piscataway NJ when its availabe. All 50 States Can Qualify for the Federal Tax Credit. Federal tax credit gives individuals 30 off a ChargePoint Home Flex electric vehicle charging station plus installation costs up to.

Unlike some other tax. No cash may be dropped off at any time in a box located at the front door of Town Hall. The credit begins to phase out for a manufacturer when that manufacturer sells.

The federal government offers a tax credit for EV charger hardware and EV charger installation costs. Before the Inflation Reduction Act the limit on the amount of the EV charger tax credit for businesses was 30000 which still applies to projects completed before the end of. All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500.

Businesses and other organizations that install EV chargers at their facilities can qualify for an incentive of up to 30 of the cost. The Federal Tax Credit for Electric Vehicle Chargers is Back. For residential installations the IRS caps the tax credit at 1000.

Ev Charging Station Tax Credits Are Back Inflation Reduction Act Extension Of The Section 30c Tax Credit Blogs Renewable Energy Outlook Foley Lardner Llp

Teqlease Capital Works With Mcdougall Capital Consulting To Advise On Tax Breaks Rebates And Equipment Financing For Electric Vehicle Charging Stations Teqlease Capital

How The Federal Electric Vehicle Ev Tax Credit Works Evadoption

Plug In Electric Vehicle Credit Irc 30 And Irc 30d Internal Revenue Service

How Much Does It Cost To Install An Ev Charger Carvana Blog

Is There An Ev Tax Credit In Georgia United Bmw

Everything You Need To Know About The Federal Investment Tax Credit

To Fight Inflation Pass Ev Tax Credits Now The Hill

Biden Fy 2022 Budget Doubles Down On Commitment To Electric Vehicles Ihs Markit

U S Senate Panel Wants To Raise Ev Tax Credit As High As 12 500

Ev Tax Credit May Be Out Of Reach For Most Consumers Roll Call

/https://www.forbes.com/wheels/wp-content/uploads/2022/08/EVCreditsEnd_Main.png)

Federal Tax Credits End Suddenly For Most Evs Plug In Hybrids Forbes Wheels

Federal Tax Credits Are Finally Coming Back But There Is A Lot To Sift Through Green Auto Market

How To Get The Federal Ev Charger Tax Credit Forbes Advisor

What To Know About The Federal Tax Credit For Electric Cars Capital One Auto Navigator

Alternative Fuel Vehicle Refueling Property Credit

Federal Tax Credit For Ev Charging Stations Installation Extended

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

U S Says About 20 Models Will Get Ev Credits Through End Of 2022 Reuters